If there were $100 billion in reverse repo yesterday, and $105 billion today, the current total is $105 billion, not $205 billion. In this fashion, when we look at charts of reverse repo levels, we must understand that these are not cumulative. A vast majority are overnight loans (all of the recent Fed activity is overnight (O/N), "rolled over" day after day. This leaves the SOMA portfolio the same size, as securities sold temporarily under repurchase agreements continue to be shown as assets held by the SOMA in accordance with generally accepted accounting principles, but the transaction shifts some of the liabilities on the Federal Reserve’s balance sheet from deposits held by depository institutions (also known as bank reserves) to reverse repos while the trade is outstanding.Īn important aspect of repos are their short-term nature.

When the Desk conducts RRP open market operations, it sells securities held in the System Open Market Account (SOMA) to eligible RRP counterparties, with an agreement to buy the assets back on the RRP’s specified maturity date. While reverse repos are when eligible parties swap dollars for Treasuries, taking dollars out of the market and bringing Treasuries back in.Īccording the NY Fed: A reverse repurchase agreement conducted by the Desk, also called a “reverse repo” or “RRP,” is a transaction in which the Desk sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future.

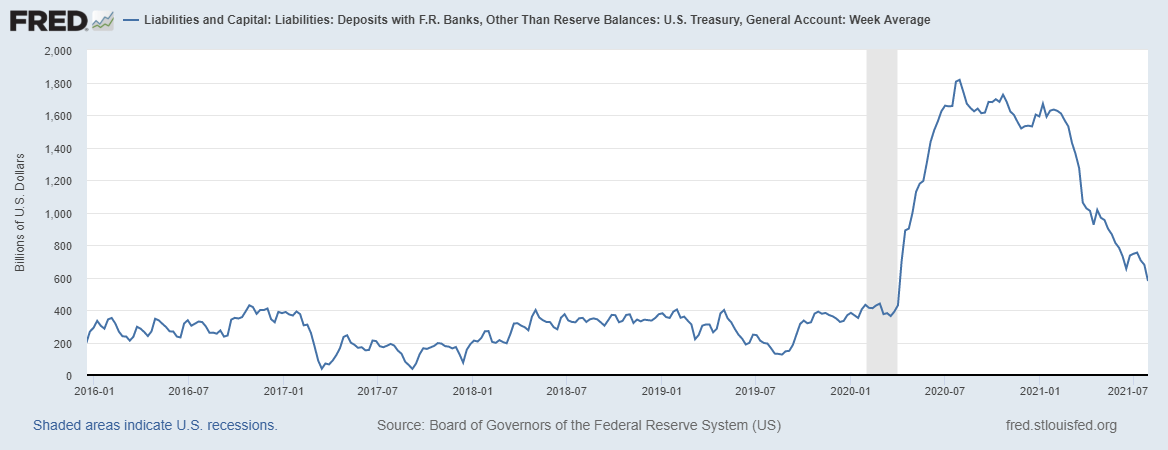

In QE, the Fed takes Treasuries and MBS out of the market by swapping for reserves held at the Fed. Reverse Repo works in the opposite direction as QE. Let's dig in and find out what we can learn. Right now, there is no imminent crisis, but the system is definitely signaling fragility, exactly what the Fed doesn't want in an era of deflationary pressure and a depressionary mindset. Why is this worthy of the label "Crisis", "Alert", "Explosion"? It is my contention that we are seeing rising levels of reverse repo because of the expiration of the SLR exemption forced a situation where banks can't accept more deposits and their ability to absorb more reserves is questionable. "RRP Explosion": Fed Reverse Repo Soars To Third Highest With "Incredible Amount Of Cash".Fed Alert: Overnight Reverse Repo Usage Soars Above Covid Crisis Highs.Repo Crisis Looms: Fed's Reverse Repo Usage Soars To $351BN, Fifth Highest Ever.NY Fed eases eligibility requirements for reverse repo facility.Some people have jumped to saying it is stealth QT (quantitative tightening) because the Fed is worried about too much inflation. Over the last couple of weeks reports have started flying that the Fed is partaking in a record amount of reverse repo transactions.

0 kommentar(er)

0 kommentar(er)